Why Behavior Matters More Than Markets

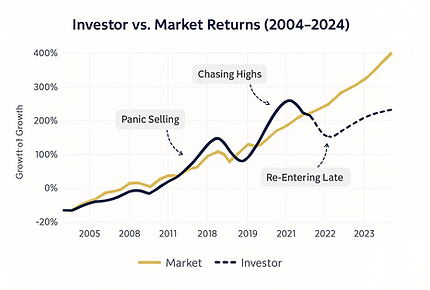

Markets fluctuate. Human behavior magnifies those fluctuations.

Behavioral finance studies the emotional and psychological influences that drive financial decisions — from fear and greed to overconfidence and loss aversion.

At RcoWealth, we apply these insights to help clients stay grounded during volatility, remain focused on long-term goals, and build lasting confidence in their financial plan.

The pain of losing is twice as strong as the pleasure of gaining — leading investors to hold losing positions too long or sell winners too soon.

We remember recent events more vividly, which can make the latest market move feel like a long-term trend.

The belief that “this time is different” can lead to unnecessary risk-taking or ignoring diversification principles.

Behavioral finance isn’t about eliminating emotion — it’s about managing it.

Through personalized planning and education, RcoWealth helps clients transform behavioral awareness into smarter investing habits and disciplined long-term decisions.